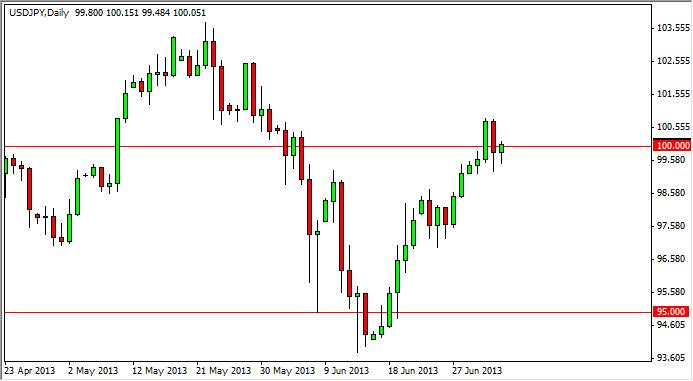

The USD/JPY pair fell during the session on Thursday, but bounced enough to form a hammer at the 100 level. This market continues to be one of our favorite, as there is so much action involving the Yen in general. This market is certainly buoyed by the Bank of Japan, and as a result we feel that we are building sideways momentum to eventually breakout based upon not only the overall outlook for the Japanese economy, but the quantitative easing going on by the Bank of Japan itself.

That being the case, today is nonfarm payroll Friday, and because of this we feel that the jobs report number will be one of the most important drivers of this pair in the short term. Interestingly enough, we feel that this market is a one-way trade, regardless what the numbers come out as. After all, the markets in America will look at the jobs report number being bad as a positive for markets in general, as the Federal Reserve will continue to add to quantitative easing, which should work against the value of the Dollar in general. However, the Federal Reserve and its quantitative easing program is nowhere near as strong as the Bank of Japan, so the initial selloff should find people willing to step in and buy this pair below.

On the other hand, if we get a strong employment number, it’s very possible that this market will continue to go straight higher simply because of the fact that people will be looking at the Federal Reserve to taper off of quantitative easing very shortly. In fact, that is the attitude of the markets right now, that they essentially believe the Federal Reserve will taper off of the quantitative easing in the fourth quarter of this year, and the market seem to be pricing that in when it comes to this pair. That is mainly because the pair tends to follow the differential and 10 year bonds between the two countries. As bond rates are rising overall in the United States, naturally money continues to flow from left to right across the Pacific Ocean and find a home in America.

Written by FX Empire