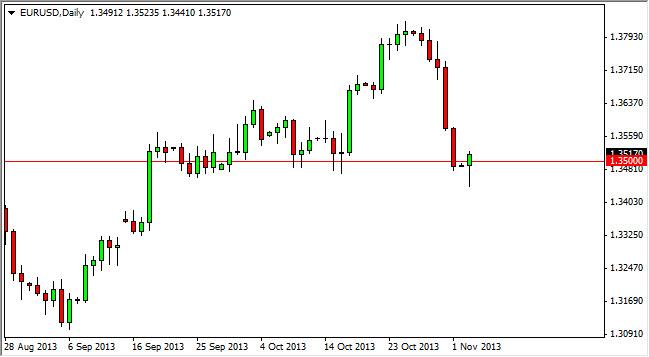

The EUR/USD pair fell initially during the session on Monday, but found supportive action at the 1.35 region. This area has been important several times in the past, and as a result the market looks ready to bounce and go higher. The market has been strong every time it gets down to this area, and the pair should find plenty of buyers because of this. In fact, we are buying on a break above the top of the hammer.

The pair will continue to see strength as long as the Federal Reserve is in a position that keeps them from tapering off of quantitative easing. As the jobs number comes out at the end of the week, we think this pair may try to front run the announcement, as traders will try to anticipate the numbers. We believe the non-farm numbers will be light, and as a result the Fed will find itself waiting even longer to begin to cut back on the bond buyback program, and as a result the Dollar will continue to weaken overall. The Euro is known as the “anti-Dollar”, and because of this we believe this pair will continue to show strength as the world runs to Europe as a result.

The hammer that has formed for the Monday session looks healthy, but if we managed to break below the bottom of that candle, this would of course be a very bearish sign. If we were to do so, the market should head down to the 1.33 level. The area down there should be just as supportive, and because of this we still think that the market is “buy only” pair. This pair should end up forming a longer-term uptrend as well, and in our opinion will head towards the 1.40 level before too long. This market will continue to focus on the Federal Reserve, and not much else although good economic numbers will continue to help if coming out of the European Union. The one caveat will be if the jobs number in the US finally start to pick up.

Written by FX Empire