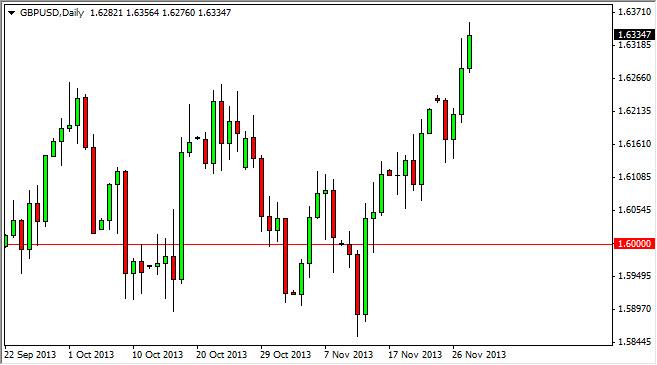

The GBP/USD pair rallied during the session on Thursday, breaking above the 1.63 handle. This is an area that we said had to be cleared in order for us to become overly bullish of this market, which we now are. The one caveat of course is that was Thanksgiving in America, so of course some of the liquidity would have been drained out of the marketplace. Nonetheless, we feel that this market should continue to go higher, and pullbacks will offer buying opportunities going forward.

A break of the highs would also serve the same purpose, showing that the market will eventually hit the 1.65 handle. It is at that area that we expect to see some resistance, mainly because of the fact that it is a large, round, psychologically significant number. There would be sellers their based upon that premise alone, plus the fact that on the longer-term charts it does show some significant.

However, we feel that unless the Federal Reserve does in fact start to taper off of quantitative easing as the markets are concerned about, this pair should continue to go higher over the longer term. The British pound of course is one of the stronger currencies in the world right now, and we believe that should continue based upon the momentum that the market has built up. There’s no reason to sell this market at the moment, so any pullback at this point time should be met by strong support below, especially around the 1.6250 handle, which was the site of the most recent breakout.

If the Federal Reserve does in fact start talking about tapering, that of course changes everything, and then at that point in time this market could fall rather drastically. However, that probably won’t happen anytime soon, so a rally for the next couple of weeks really wouldn’t be much of a surprise at this point in time. With that in mind, we feel that you can only buying this market right now, and selling is not possible until the Federal Reserve does in fact mentioned tapering.

Written by FX Empire