The GBP/USD pair fell during a significant portion of the session on Tuesday, but as we have seen time and time again, the market finds buyers below. With that, we find this market to be bullish, and will continue to buy the British pound on dips. With that, we feel that the market will continue to go higher given enough time. Because of this, we feel that this mortgage you continue to go much higher, and believe that the market should find more and more buyers in the near-term.

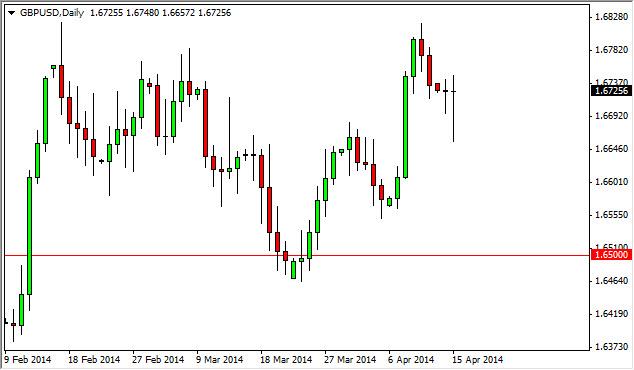

The pullback that we saw during the Tuesday session only strengthens our resolve on the bullishness of this market. We believe that the market will continue to find a lot of support and the 1.6650 level, as well as the 1.65 level, an area that we feel that the market has essentially found to be a “floor”. With that, it is not until we clear the 1.64 level that we could be convinced to sell this market as we believe it is that bullish. After all, the recent consolidation should just be continuation, not anything beyond that.

The hammer of course is a bullish sign as well, so we have absolutely no reason to start selling this market anytime soon. A break above the recent high not only is bullish though, it’s sending the market to the 1.70 level given enough time. That is our longer-term target, so it’s almost impossible to imagine any other scenario at this point. Don’t get me wrong, it’s likely that we will chop around as we go higher, but at the end of the day there’s no reason to sell given the fact that it is such a bullish market overall. We would expect the 1.70 level to be massively resistive though, so a pullback at that point in time is not a surprise at all. We would be more than willing to buy above the level as well, but based upon the longer-term charts, we suspect that the market will certainly have a lot to do within the general vicinity.