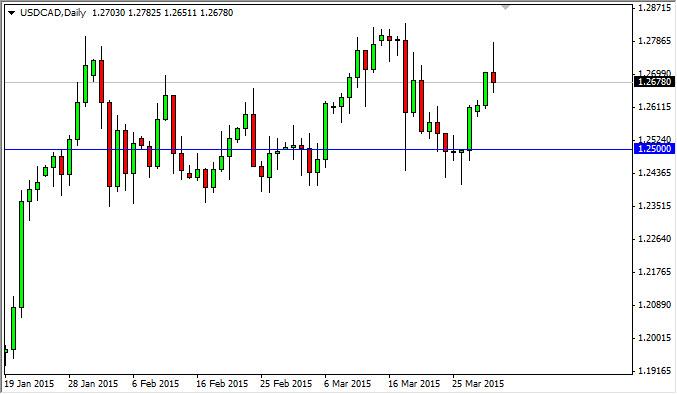

The USD/CAD pair initially went much higher during the course of the session on Tuesday, but turned back around to form a shooting star. However, the shooting star suggests not weakness, but a continuation of the consolidation that we have been in for some time now. That being the case, the market looks as if it has a bit of a bottom in it at the 1.24 handle, and a top at the 1.28 handle. That being the case, the market looks like it’s ready to continue going back and forth in this general vicinity, so if we do fall from this level, we think it is simply best to wait for supportive candle in order to start buying again. We don’t really want to short this market, because quite frankly the US dollar is the strongest currency in the world right now. On top of that, you have to keep in mind that the Bank of Canada has done an interest-rate cut here recently, while the Federal Reserve continues to step away from the quantitative easing game.

The crude oil markets continue to look very soft in general, which of course will not help the Canadian dollar. After all, the Canadian dollar is highly influenced by the oil markets in general, so of course that’s not going to help. However, you have to keep in mind the gold markets look a little bit soft as well, and that of course doesn’t help the Canadian dollar either as Canada is an exporter of gold.

Ultimately, we believe that this market heads to the 1.30 level given enough time, but it will be a difficult level to get above as it was the scene of massive resistance during the financial crisis. However, we do believe that eventually this pair breaks above there, and this is especially true if the crude oil markets continue to fall. A move below $50 in the Light Sweet Crude market will almost undoubtedly make this pair sliced through the 1.30 and continue to go much higher, possibly making this a “buy-and-hold” situation.