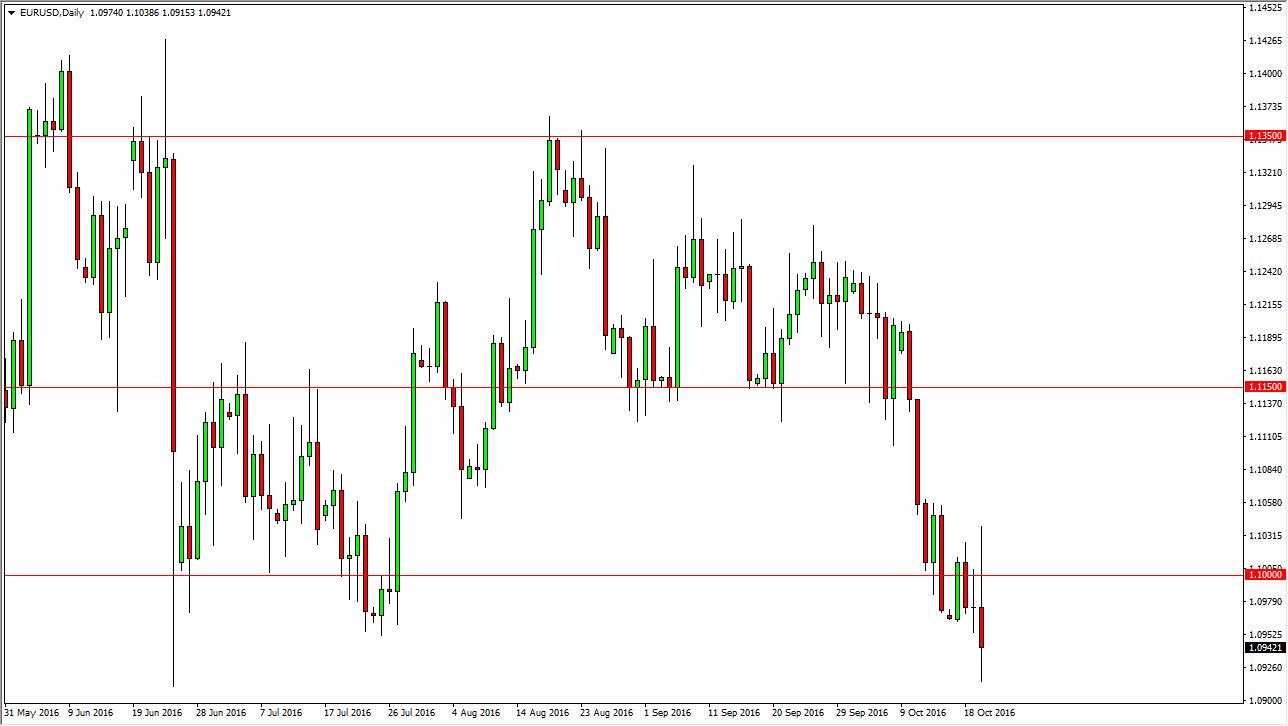

The EUR/USD pair initially tried to rally during the day on Thursday, but found enough resistance above the 1.10 level to turn things back around and fall rather significantly. Although this is an area that I have said previously should be resistive and I’m not necessarily surprised that we pulled back, the reality is that the European Central Bank has suggested that they are going to sit on the decision as to whether or not to taper off of quantitative easing until at least December, which is a bit of backpedaling from the tapering that they had promised. Because of this, there seems to be quite a bit of selling pressure on the Euro around the Forex world, and especially against the US dollar where we see the only real hope of an interest-rate hike anytime soon. Truth be known, that’s probably a bit dubious, but at this point in time it appears that the markets are more interested in selling than anything else so I look at any opportunity to do so as a way to go.

If we can break down below the bottom of the candle for the session on Thursday, we should continue to go down towards the 1.05 level. Rallies will continue to find resistance near the 1.10 level above, and the massive selling that we’ve seen recently should continue although I think that a lot of the easy money has Artie been made. Ultimately, this is a market that is going to continue to fall as the problems in the European Union go much further and much deeper than quantitative easing, so at this point in time I remain very bearish of the Euro, but I recognize that it’s likely be a straight shot down. I continue to sell rallies on signs of exhaustion and failure, and hold for a move down to 1.08, 1.05, and then the potential longer-term target of parity. As far as buying is concerned, I don’t even have a scenario in which I start going it anytime soon as far as I can see.