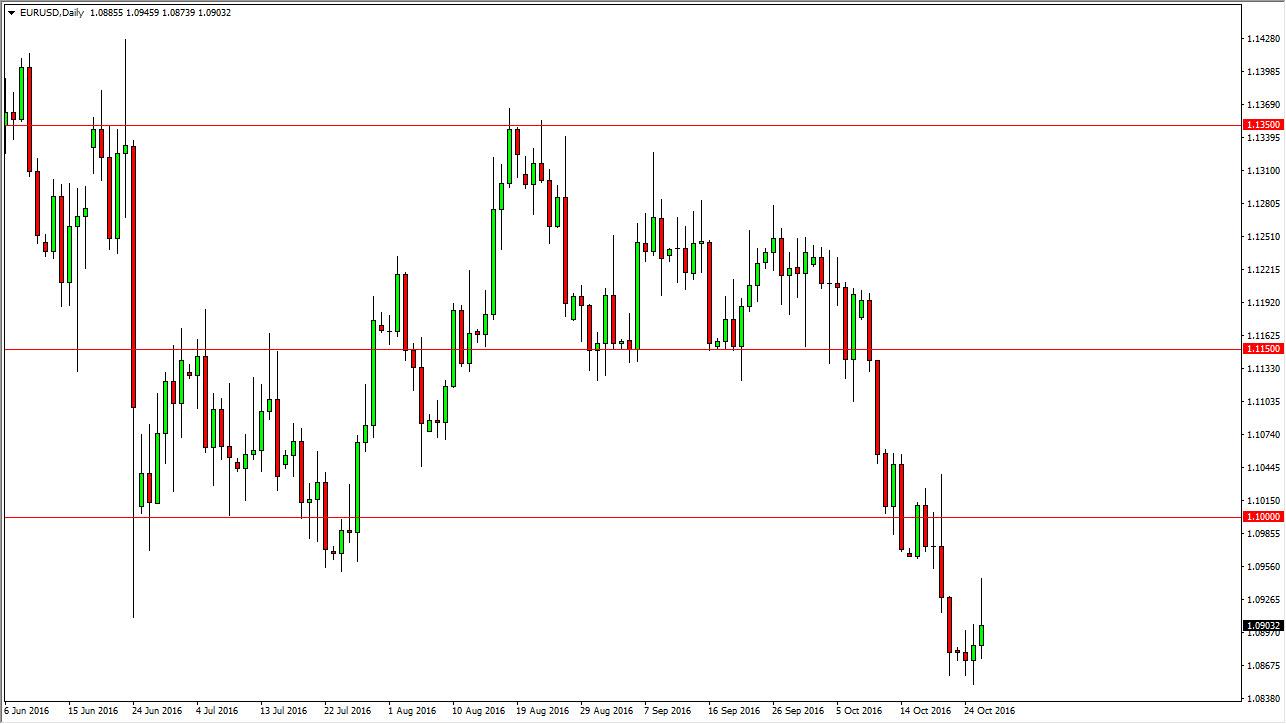

The EUR/USD pair rallied rather significantly during the day on Wednesday, touching the 1.0950 region. However, we gave up a lot of this gains in order to form a shooting star like candle, and that of course is a very bearish sign. Quite frankly, we have been oversold in this bounce was needed by the market in order to continue the downward pressure. With that being the case, I am a seller overall and I’m looking for a break below the bottom of the candle for the Wednesday session in order to start shorting again. The market will continue to offer “value” in the US dollar retirement rallies at this point in time as far as I can see, and of course you have to keep in mind that the Federal Reserve is looking to find some type of reason to hike rates, while recently the European Central Bank has suggested that they will wait until they get the data from the month of December to even discuss tapering off of quantitative easing.

With such a massive difference in interest-rate policies, it makes sense that the US dollar will continue to strengthen in general. I’m not looking for some type of meltdown, I just recognize that the sellers are most certainly in control. On top of this, the market looks very likely to find quite a bit of resistance at the 1.10 level above, as it is the “ceiling” in this market at the moment. I do think that the market could very well reach down towards the 1.05 handle, but it is going to take some time to get down there. I don’t know if we can break down below there, but at that point I would be a value way what’s going on.

I don’t have any scenario in which a willing to buy this pair, although you could make an argument for doing so above the 1.1050 level, as it has been so bearish recently, so breaking above that of course would mean something in the end. Regardless, expect a lot of choppiness.