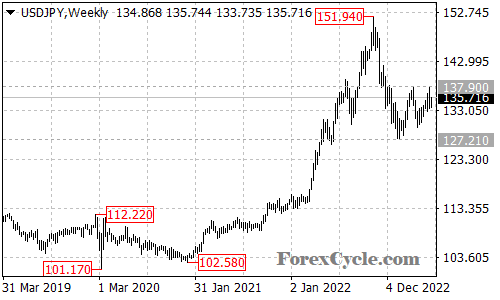

USDJPY is currently facing a key resistance level at 137.90, and traders are closely watching to see whether the currency pair will be able to break above this level. If USDJPY manages to break through 137.90, it could signal further upside momentum and potentially take the price towards 142.00 and 145.50.

However, if the resistance level at 137.90 holds, then we could see the currency pair continue to trade sideways in a range between the key support level of 127.21 and the resistance level. In this scenario, traders should be cautious and look for potential trading opportunities within the range.

It’s worth noting that a breakdown below the support level of 127.21 could signal a resumption of the long term downtrend from the October 2022 high of 151.94. In this case, traders could look for short positions and potential targets at lower levels such as 124.50 and 122.00.

Overall, traders should pay close attention to the key resistance level of 137.90 and the support level of 127.21 in the coming weeks to determine the next direction of USDJPY. If the resistance level holds, we could see range trading continue, while a break above this level could signal further upside momentum.