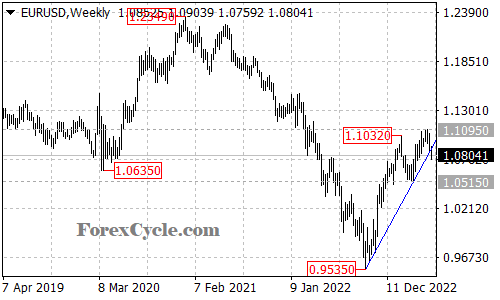

The EURUSD currency pair has recently broken below the rising trend line on the weekly chart, signaling the start of a lengthier consolidation period for the long-term uptrend from 0.9535. This development has garnered attention from traders and investors, as they assess the potential range-bound trading in the coming weeks.

The break below the rising trend line suggests that the Euro’s upward momentum has slowed, and the market is now in a consolidation phase. Range trading between the levels of 1.0515 and 1.1095 is expected to dominate the price action over the next several weeks. This range provides traders with clear boundaries to monitor and potential trading opportunities as they navigate the market.

During this consolidation phase, the support level at 1.0515 will be a crucial level to watch. As long as this support holds, there is a possibility that the uptrend could resume once the consolidation is complete. If the Euro manages to gather enough momentum and breaks above the upper range level of 1.1095, it could set the stage for another rise towards the 1.1400 area.

However, traders should also be aware of the downside risks. A breakdown below the support level at 1.0515 would indicate that the uptrend from 0.9535 has completed at the recent high of 1.1095. In such a scenario, a deeper decline could be expected, potentially pushing the Euro towards the 1.0200 area. Traders with a bearish outlook on the Euro will closely monitor any signs of sustained weakness and a potential breach of the support level.

In conclusion, the EURUSD pair has entered a consolidation phase after breaking below the rising trend line on the weekly chart. Range trading between 1.0515 and 1.1095 is expected in the coming weeks, providing traders with opportunities within this range. As long as the support level at 1.0515 holds, there is a possibility for the uptrend to resume, with a potential rise towards 1.1400. However, a breakdown below 1.0515 would suggest a completion of the uptrend, leading to a deeper decline towards 1.0200. Traders should monitor price action and key support and resistance levels to navigate this evolving market landscape.