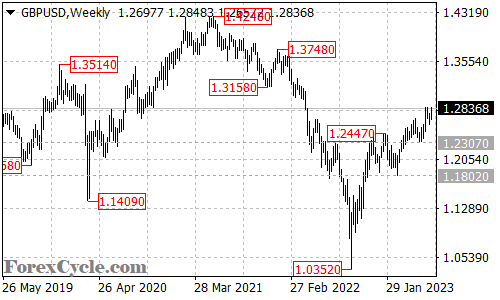

The GBPUSD currency pair has been maintaining its long-term uptrend, which originated from 1.0352. This upward trajectory suggests that further gains could be expected in the coming weeks, with a potential next target in the 1.3200 area. This projection provides a positive outlook for traders who have taken a bullish stance on the pair.

In the near term, it is crucial to monitor the support level at 1.2307. As long as the price remains above this level, the bullish momentum is likely to persist. However, a breakdown below 1.2307 would raise concerns about the strength of the uptrend. If this support level is breached, it could potentially lead to a retracement in price, with the pair potentially falling back towards 1.1802. A move below 1.1802 might indicate that the long-term uptrend has reached its completion.

In summary, the GBPUSD continues to exhibit a long-term uptrend from 1.0352, suggesting the potential for further upward movement. The next target for the pair is projected to be in the 1.3200 area. However, traders should be mindful of the near term support level at 1.2307. A breakdown below this level could result in a retracement towards 1.1802, potentially signaling the completion of the long-term uptrend. Vigilance and adaptability are crucial when navigating the foreign exchange market, as conditions can change rapidly.