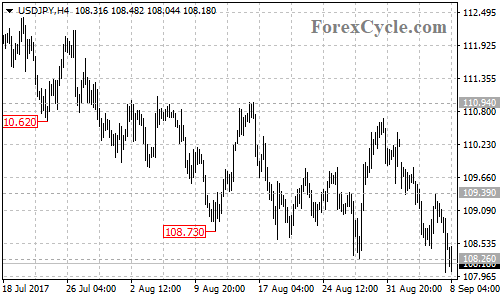

USDJPY broke below 108.26 support, indicating that the downtrend from 114.49 (Jul 11 high) has resumed. Further decline could be expected and next target would be at 106.50. Near term resistance is at 109.39, only break above this level could bring price back towards 110.94.