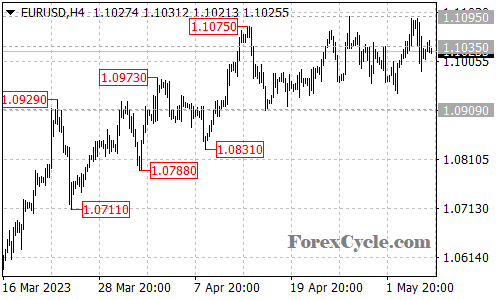

The EURUSD pair attempted to break above the key resistance level at 1.1095 but failed to do so and has since remained in a sideways movement within a trading range of 1.0909 to 1.1095. It is expected that there will be a further drop towards the 1.0909 support level in the coming days.

The consolidation of the pair within the trading range may simply be a temporary pause for the uptrend that began from the March low of 1.0515. As long as the 1.0909 support level holds, a continued sideways movement could lead to a possible breakout above the 1.1095 resistance level, which would take the price to the 1.1200 zone.

However, a breakdown below the 1.0909 support level would indicate a potential reversal of the uptrend and aim for the next support level at 1.0850. This scenario would be confirmed if there is a sustained downside move below the 1.0909 support level.

In summary, traders should closely monitor the price movement of the EURUSD pair in order to prepare for potential trading opportunities. A continued consolidation between the 1.0909 support and 1.1095 resistance levels may be considered as a consolidation phase for the uptrend from the March low, while a breakdown below the 1.0909 support would signal a potential reversal of the trend.