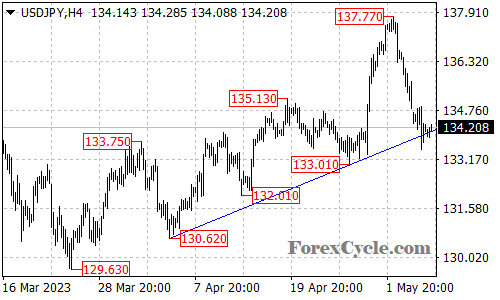

The USD/JPY currency pair has broken below the rising trend line on the 4-hour chart, indicating that the uptrend from the low of 129.63 has ended at the high of 137.77. This could signal a further decline in the pair in the near term.

Currently, the pair is trading at 134.20, and a decline towards the support level of 132.00 followed by 129.63 is possible in the coming days.

On the upside, the near-term resistance for the pair is at 134.90. If the pair manages to break above this level, it could climb back towards the 135.80 zone. However, the overall trend for the pair remains bearish.

The break below the rising trend line suggests that the market sentiment has turned bearish, and traders may look to sell on any rallies. The key support level for the pair is at 129.63, and a break below this level could lead to a further decline towards the next support level at 127.00.

In conclusion, the USD/JPY currency pair has broken below its rising trend line, indicating a potential further decline in the pair. Traders should monitor the key support and resistance levels closely to identify potential trading opportunities.