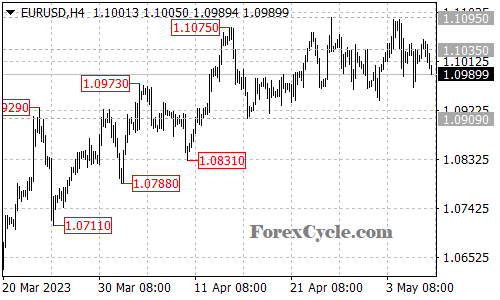

EURUSD has been moving sideways in a tight range between 1.0909 and 1.1095, with neither the bulls nor the bears taking control of the pair. The lack of directional bias has kept the pair within the range for an extended period. However, the sideways move could be treated as consolidation for the uptrend from the Mar low of 1.0515.

If the bulls manage to push the pair above the 1.1095 resistance level, it would indicate the resumption of the uptrend from the Mar low of 1.0515. In that case, the next target would be around the 1.1200 area. On the other hand, if the bears take over and the pair breaks below the key support at 1.0909, it would signal the completion of the uptrend. In that case, the next target would be around 1.0800, followed by 1.0710.

Currently, the EURUSD remains in a state of consolidation, with a lack of momentum in either direction. Traders are advised to keep an eye on the key support and resistance levels of 1.0909 and 1.1095, respectively, to determine the next possible direction of the pair.