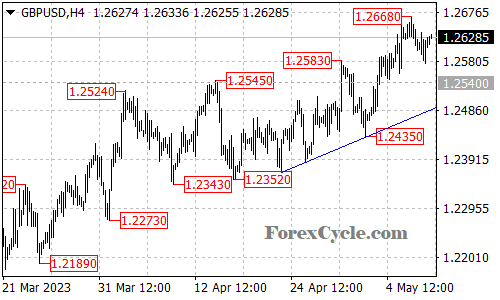

GBPUSD has been in an uptrend since the March low of 1.1802. However, the pair recently pulled back from its recent high of 1.2668, which may be seen as a period of consolidation for the uptrend. The key level to watch is the support level of 1.2540, as a breakdown below this level could lead to further downside movement.

If the support level of 1.2540 is breached, the pair could test the support of the rising trend line on the 4-hour chart, which is another crucial support level to watch. If the trend line is broken, the next support level would be at 1.2435.

On the upside, if the pair continues to consolidate and breaks above the recent high of 1.2668, it would suggest that the uptrend has resumed, with the next target being 1.2800.

Overall, the bias remains bullish as long as the pair stays above the trend line support and the key support level of 1.2540. However, a break below these levels could signal a shift in the trend, and traders should keep a close eye on the price action at these levels.