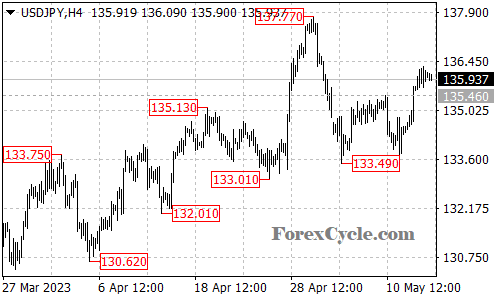

The USDJPY pair has made a significant breakthrough, surpassing the key resistance level at 135.46. This development suggests a shift in market dynamics, indicating that the pair is now in an uptrend from its previous low of 133.49. As a result, traders and investors may expect further upward movement in the coming days, with the next target set at 137.77.

The recent breakout above the resistance level at 135.46 has injected renewed optimism into the USDJPY market. This upward momentum signals the potential for additional gains, as the pair continues its ascent. Traders should closely monitor the price action and key support and resistance levels to identify potential entry and exit points.

In terms of support, the USDJPY pair has established several crucial levels to keep an eye on. The immediate support lies at 135.46, which was the previous resistance level. Should the price experience a temporary pullback, this level may act as a support zone. Further support levels can be found at 134.80 and 133.49, the latter being the previous low. A breach below these support levels could indicate a reversal and trigger another decline towards 129.63, the previous low point.

In conclusion, the USDJPY pair has broken above the resistance level at 135.46, signaling a shift in market sentiment and suggesting an uptrend from the previous low. Traders may anticipate further upward movement in the near term, with the next target set at 137.77. Nonetheless, it is important to closely monitor support levels, as a breach below these levels could indicate a reversal. Implementing effective risk management strategies and staying informed about market developments will be key to successful trading in the USDJPY market.