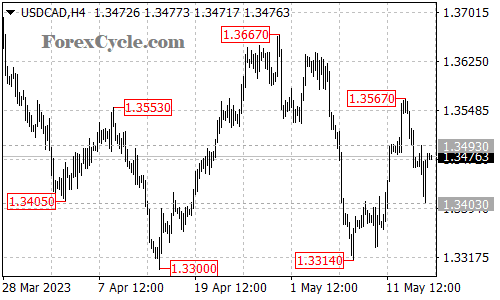

The USDCAD pair has continued its downward trajectory, with the recent decline extending as low as 1.3403. This suggests that the bears are still in control, and further downside movement is a possibility. Traders should closely monitor the support level at 1.3403, as a breakdown below this level could trigger another leg of selling pressure, potentially targeting the 1.3300 area.

The prevailing bearish sentiment in USDCAD indicates that sellers continue to dominate the market. As the pair eyes further decline, the next key support to watch is at 1.3403. A sustained break below this level would validate the downside momentum and open the door for a potential move towards the psychological level of 1.3300. Traders should exercise caution and be prepared for increased volatility as the price approaches these support levels.

On the upside, the pair faces immediate resistance at 1.3493. A breakout above this level would suggest a potential end to the downward move from 1.3567 and could pave the way for a corrective rally. In such a scenario, traders might anticipate a move towards the 1.3567 resistance level.

To summarize, the USDCAD pair has extended its downside move, reaching as low as 1.3403. Further decline is possible, with a breakdown below 1.3403 potentially leading to a test of the 1.3300 support level. Resistance is seen at 1.3493, and a breakout above this level could signal a temporary halt to the bearish momentum. Traders should remain vigilant and adapt their strategies based on evolving market conditions to navigate the USDCAD pair effectively.