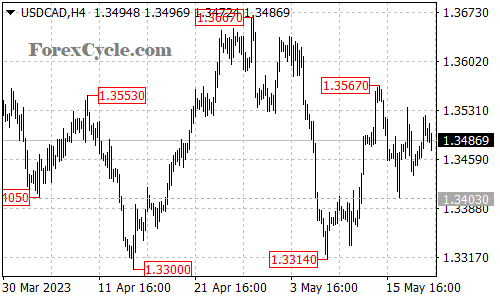

The USDCAD pair has been trading within a relatively range, moving sideways between the support level at 1.3403 and the resistance level at 1.3567. This consolidation phase indicates a temporary pause in the market as buyers and sellers assess the next potential move for the pair.

Traders should anticipate the continuation of this sideways movement for the next few days as the market awaits a breakout direction. The range-bound trading suggests a balance between supply and demand, with neither buyers nor sellers exerting significant dominance at this point.

Should the price break below the support level at 1.3403, it could signal a renewed downward momentum for USDCAD, potentially leading to another decline towards the next support level at 1.3300. Traders will closely monitor this level for any potential downside moves.

Conversely, a breakout above the resistance level at 1.3567 could indicate renewed strength in the pair, potentially leading to a further upward move towards the next resistance level at 1.3667. Traders should be watchful for any bullish price action and volume patterns that could suggest a shift in market sentiment.

In summary, USDCAD has been consolidating in a sideways range between 1.3403 and 1.3567. Traders should anticipate this range-bound trading to continue in the near term, waiting for a breakout direction to provide further clarity. A break below 1.3403 could lead to a potential decline towards 1.3300, while a breakout above 1.3567 could open the door for further upside towards 1.3667. It is important for traders to stay informed and adapt their strategies as market conditions evolve.