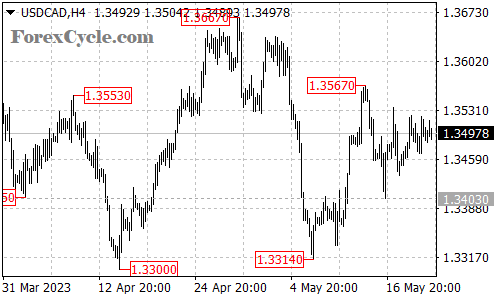

The USDCAD currency pair has continued its sideways movement, consolidating within a trading range between 1.3403 and 1.3567. Traders should closely monitor key support and resistance levels as the pair remains in this range-bound phase.

In the near term, the support level to watch is at 1.3465. A breakdown below this level could signal a potential decline towards the next support level at 1.3403. If selling pressure persists, the pair may aim for the 1.3300 support level. Traders should monitor price action and accompanying indicators to assess the strength of any potential downside movement.

On the upside, the near term resistance level is at 1.3525. A break above this level could open the door for a test of the 1.3567 resistance level. If the buying momentum continues, the pair may target the 1.3667 resistance level. Traders should closely watch for any signs of a breakout above these key resistance levels, which could indicate a potential shift in the price action.

Range-bound markets present traders with both challenges and opportunities. It is important to adapt trading strategies to suit the prevailing conditions, such as employing range trading techniques or using oscillators to identify overbought and oversold levels. Traders should also exercise caution and implement proper risk management practices to mitigate potential losses during range-bound periods.

To summarize, the USDCAD currency pair remains range-bound between 1.3403 and 1.3567. Traders should closely monitor the support level at 1.3465 and the resistance level at 1.3525 for potential breakouts or reversals. A breakdown below 1.3465 could lead to further downside movement towards 1.3403 and 1.3300. Conversely, a breakout above 1.3525 may indicate a potential move towards 1.3567 and 1.3667. Adapting trading strategies to suit range-bound conditions and implementing proper risk management practices will be essential for navigating the USDCAD market effectively.