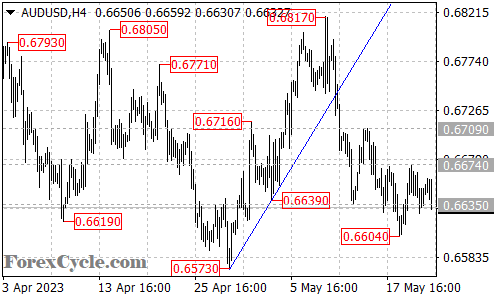

The AUDUSD currency pair has been consolidating in a narrow trading range between 0.6604 and 0.6674, as market participants assess the next potential direction. Traders are closely monitoring this range, as it provides valuable insights into the near-term outlook for the pair.

As of now, the downtrend from 0.6817 remains intact, and as long as the 0.6674 resistance level holds, the bias remains tilted to the downside. Traders will be watching for a potential breakdown below the lower boundary of the range, which could signify a resumption of the downtrend. Should this occur, the next target for AUDUSD would be the 0.6573 support level.

On the other hand, a breakout above the 0.6674 resistance level would indicate a potential shift in the market sentiment. If the pair manages to surpass this hurdle, it could then aim for the next resistance level at 0.6709. A decisive move above 0.6709 would suggest that the downtrend has potentially concluded at 0.6604, opening the door for another upward move towards the 0.6800 resistance area.

While the trading range between 0.6604 and 0.6674 persists, it is crucial for traders to exercise caution and adapt their strategies accordingly. Setting appropriate stop-loss orders and closely monitoring price movements are vital risk management techniques to employ in such market conditions.

To summarize, AUDUSD is currently in a sideways consolidation phase within the range of 0.6604 to 0.6674. The bias remains tilted to the downside as long as the resistance at 0.6674 holds. A breakdown below the range could indicate a resumption of the downtrend, targeting the 0.6573 support level. Conversely, a breakout above 0.6674 may lead to a shift in sentiment, with potential resistance at 0.6709 and a further rise towards 0.6800. Traders should stay informed of relevant market developments and employ proper risk management techniques to navigate the AUDUSD currency pair effectively.