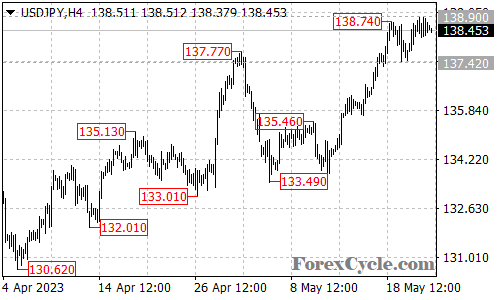

The USDJPY currency pair has entered a consolidation phase, displaying range-bound trading as it continues the overall uptrend that commenced from 133.49. Traders should anticipate price action between the levels of 137.42 and 138.90 in the near term.

As long as the support level at 137.42 remains intact, the broader uptrend in USDJPY is likely to resume. In such a scenario, market participants can set their sights on the next target around the 141.00 area. This level represents a significant resistance zone and could act as a potential milestone for further upside momentum.

However, it is crucial to closely monitor the support level at 137.42. A breakdown below this level would suggest a possible shift in market sentiment and could lead to a deeper correction. In the event of a sustained breach, the price may head towards the 135.00 area, which serves as the next support level.

While the range trading scenario persists, traders should exercise caution and closely monitor market developments for potential breakout opportunities. It is advisable to wait for a clear indication of a breakout above the upper range boundary at 138.90 or a breakdown below the lower range boundary at 137.42 before committing to new trading positions.

In summary, USDJPY is currently consolidating within a range, indicating a temporary pause in the overall uptrend from 133.49. Traders should anticipate range-bound trading between 137.42 and 138.90, with a potential resumption of the uptrend upon a bounce from the support level. A breakout above 138.90 or a breakdown below 137.42 could offer new trading opportunities. Monitoring market developments and implementing effective risk management strategies remain crucial when navigating the USDJPY market.