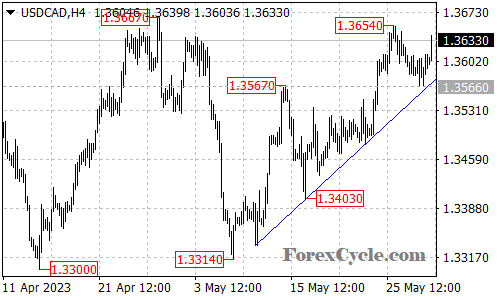

The USDCAD currency pair has recently shown resilience as it failed to break below the rising trend line on the 4-hour chart. This suggests that the pair remains in an uptrend that originated from the 1.3314 level. Traders are now keeping a close eye on the potential for another rise to test the key resistance level at 1.3667.

If the USDCAD manages to break above the 1.3667 resistance level, it would likely trigger a further upside move, potentially targeting the next resistance levels at 1.3740 and 1.3800. These levels would be crucial milestones to watch for as they could provide opportunities for bullish momentum to strengthen.

However, it is important to note that the 1.3566 level now acts as a key support for the pair. A break below this level could signal a potential shift in the bullish sentiment and bring the price back towards the 1.3300 support area. Traders should closely monitor price action around this support level as it could provide valuable insights into the pair’s future direction.

In summary, the USDCAD currency pair is maintaining its uptrend as it failed to break below the rising trend line on the 4-hour chart. Traders are now closely watching for a potential rise towards the key resistance level at 1.3667, with further targets at 1.3740 and 1.3800. However, the 1.3566 support level holds importance, and a break below it could shift the sentiment and bring the pair back towards 1.3300. Traders should consider both technical and fundamental factors while applying effective risk management strategies.