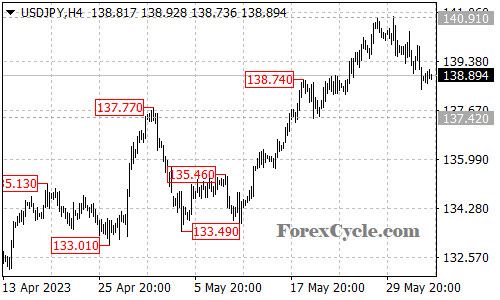

The USDJPY currency pair has experienced a significant break below the 138.60 support level, indicating a potential completion of the recent upside move from 133.49 to 140.91. This break suggests a shift in market sentiment and sets the stage for a potential deeper decline in the coming days.

Traders and investors are now closely watching for further downward movement as the pair has breached the key support level. The next target for the bears is likely to be the 137.42 support, followed by the 135.00 area. These levels may act as potential areas of consolidation or downside targets as the selling pressure intensifies.

It is important to note that near-term resistance now lies at 139.95. For a bullish scenario to regain strength, a break above this resistance level would be required to potentially retest the previous high at 140.91. Such a move could indicate a resurgence in buying interest and challenge the bearish momentum.

The break below the 138.60 support level signals a potential shift in market dynamics for USDJPY, with sellers gaining control and driving the pair lower. Traders will closely monitor price action and gauge the strength of the bearish momentum to assess the likelihood of further downside movement.