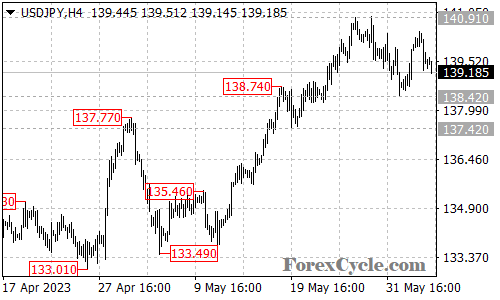

The USDJPY currency pair has been trading within a defined range, moving sideways between the support level at 138.42 and the resistance level at 140.91. Traders are closely monitoring price action within this range, as it could provide important clues about the pair’s future direction.

At present, the price movement within the range is considered to be a period of consolidation for the uptrend that began from 133.49. Traders who are bullish on USDJPY will be looking for a breakout above the 140.91 resistance level, which could potentially trigger a further upward move towards the 142.00 area. Such a breakout would suggest a resumption of the underlying uptrend and may attract additional buying interest from market participants.

Conversely, it is important to monitor the 138.42 support level within the range. As long as this level holds, the consolidation phase could continue. However, a breakdown below 138.42 would indicate that the upside move from 133.49 has potentially completed at the 140.91 resistance level. In such a scenario, traders may anticipate a bearish move towards the next support level at 135.00.