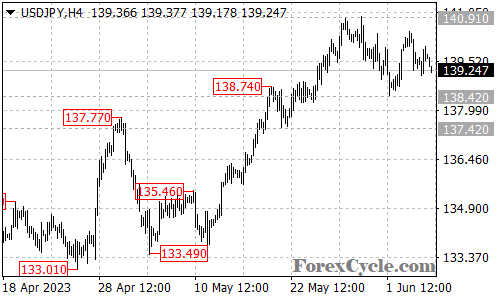

The USDJPY currency pair has been trading within a relatively narrow range, bounded by the support level at 138.42 and the resistance level at 140.91. This sideways movement suggests a period of consolidation for the pair after its previous uptrend from 133.49.

As long as the support level at 138.42 holds, the price action within the range can be viewed as a consolidation phase. Traders should closely monitor for a potential breakout above the resistance level at 140.91, as it could signal a continuation of the recent uptrend towards the next target at 142.00.

On the downside, a breakdown below the support level at 138.42 would indicate a potential completion of the upside move from 133.49. In such a scenario, the pair may experience a renewed bearish sentiment, potentially leading to a decline towards the next support level at 135.00.

In summary, USDJPY is currently consolidating within a trading range between 138.42 and 140.91. A breakout above the resistance level would indicate a continuation of the uptrend, while a breakdown below the support level could signal a bearish reversal. Traders should closely monitor technical indicators and fundamental factors to determine the pair’s next directional move. Employing effective risk management practices is essential for successful trading in USDJPY.