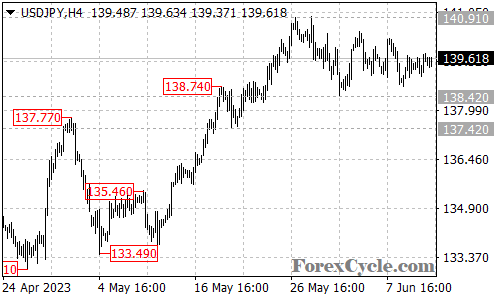

The USDJPY currency pair has been engaged in a sideways movement, confined within a trading range between 138.42 and 140.91. This consolidation phase suggests a temporary pause in the uptrend that originated from the 133.49 level. As long as the support at 138.42 remains intact, the price action within the range can be considered as a consolidation period.

Traders should closely monitor the key resistance level at 140.91. A breakout above this level has the potential to trigger a further upside move towards the 142.00 area. Such a breakthrough would signify a resumption of the uptrend and could attract additional buying interest from market participants.

Conversely, a breakdown below the support level at 138.42 would indicate a possible completion of the upside move that commenced at 133.49. In this scenario, the pair could experience a renewed downward pressure, potentially leading to another decline towards the 135.00 support level.

To summarize, the USDJPY currency pair has been trading within a range between 138.42 and 140.91, indicating a consolidation phase in the market. As long as the support at 138.42 holds, the price action can be seen as a temporary pause in the uptrend. A breakout above 140.91 would signal a potential resumption of the uptrend, while a breakdown below 138.42 would suggest a possible completion of the upside move. Traders should stay informed about relevant market developments and utilize appropriate risk management techniques to navigate the market effectively.