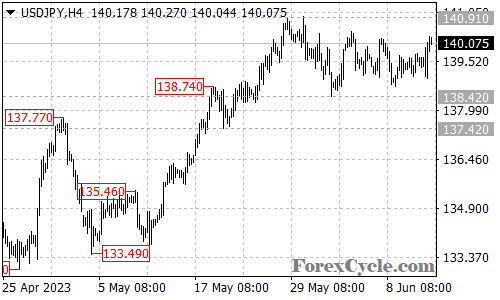

The USDJPY currency pair has been trading within a defined range, with the upper limit at 140.91 and the lower boundary at 138.42. This sideways movement suggests a period of consolidation for the uptrend that originated from 133.49. Traders are closely monitoring price action within this range for a potential breakout that could set the direction of the next major move.

While the price remains above the support level of 138.42, the consolidation within the trading range can be viewed as a healthy pause in the overall uptrend. As long as this support level holds, market participants can anticipate a continuation of the bullish momentum and a potential breakout above the resistance at 140.91. Such a breakout could trigger additional buying interest and propel the pair towards the next target around the 142.00 area.

Conversely, a breakdown below the support level of 138.42 would indicate a potential shift in market sentiment. Should this occur, it would confirm that the recent upside move from 133.49 has concluded at the 140.91 resistance level. In such a scenario, traders should be prepared for a potential decline towards the 135.00 support area.

In conclusion, the USDJPY pair has been consolidating within a trading range between 138.42 and 140.91. Traders are awaiting a breakout to establish the next major move. As long as the support at 138.42 holds, the consolidation can be seen as a period of consolidation for the uptrend from 133.49. A breakout above 140.91 would signal further upside potential, while a breakdown below 138.42 could lead to a bearish move towards the 135.00 support level. Traders should exercise caution and wait for a clear breakout before initiating new positions.