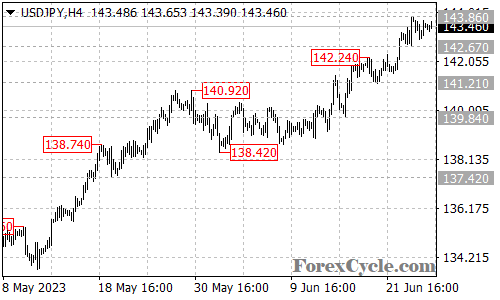

The USDJPY currency pair has been exhibiting a resilient uptrend since its low of 138.42. Although the recent pullback from 143.86 may give the impression of a reversal, it is more likely a consolidation phase within the broader uptrend. Traders are closely monitoring key support and resistance levels to gauge the pair’s future trajectory.

As long as the 142.67 support level holds, market participants can anticipate a continuation of the upside move. The next target for the pair lies around the 145.00 area, where further resistance may be encountered. Traders will be watching for any signs of a breakout above this level, which could pave the way for additional gains.

Conversely, a breakdown below the 142.67 support level would suggest a potential shift in the market sentiment. Such a development could bring the price back towards the next support level at 141.21. It is worth noting that a break below this level would serve as an important signal indicating the possible completion of the ongoing uptrend.

In summary, the USDJPY currency pair remains in an uptrend from 138.42, with the recent pullback viewed as a consolidation phase. As long as the 142.67 support level remains intact, traders can anticipate further upside movement, targeting the 145.00 area. However, a breakdown below 142.67 would shift the outlook and indicate a potential end to the uptrend, with support at 141.21. Traders should closely monitor price dynamics and stay informed to make well-informed trading decisions in the evolving USDJPY market.