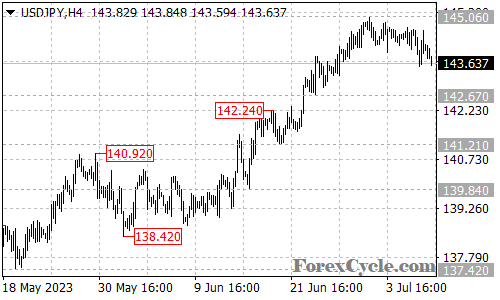

The USDJPY currency pair is currently consolidating within a range as it holds steady in its uptrend from 138.42. The price is expected to trade between the support level at 142.67 and the resistance level at 145.06 in the coming days. Traders will closely monitor price action within this range for potential breakout opportunities.

As long as the support level at 142.67 holds, the upside move in USDJPY is likely to resume. Traders will look for signs of strength near this support level, such as bullish candlestick patterns or a rebound in price, to confirm the continuation of the uptrend. A breakout above the resistance level at 145.06 would validate the bullish sentiment and potentially trigger further upside momentum.

If the pair successfully breaks above the resistance level, it could pave the way for a move towards the next resistance level at 146.40, followed by the psychological level of 149.00. However, traders should closely monitor market conditions and key economic events that may impact the USDJPY pair, as they can influence the direction of the breakout.

In summary, USDJPY is currently in a consolidation phase within the range of 142.67 and 145.06. Traders will closely monitor price action for a potential breakout above the resistance level or a bounce from the support level. A successful breakout above 145.06 could lead to further upside moves, targeting levels such as 146.40 and 149.00. Traders should remain vigilant and adapt their strategies based on market conditions and key developments.