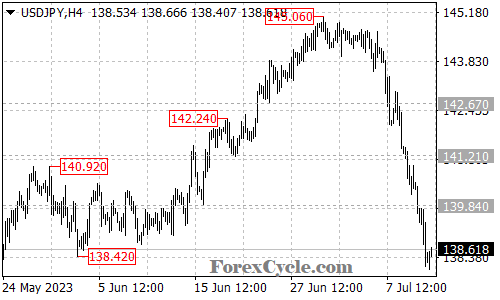

The USDJPY currency pair has experienced a substantial downward move, extending from 145.06 to as low as 138.06. This decline has been accompanied by a break below the crucial support level at 138.42, indicating the potential for further downside in the near future. With the next target set at the 137.42 area, the US dollar continues to face selling pressure against the Japanese yen.

Looking ahead, traders and analysts anticipate the potential for further decline in USDJPY. The next target at the 137.42 area represents a significant support level and could attract additional selling interest. If the pair manages to break below this level, it would signal a continuation of the downtrend and potentially open the door for additional downside movement.

However, it is important to note that currency markets are subject to fluctuations and reversals. Immediate resistance for USDJPY is currently situated at 139.25. Only a break above this level would indicate a potential completion of the ongoing downtrend. Such a scenario could lead to a relief rally for the US dollar, but it would require a substantial shift in market dynamics and sentiment.

In conclusion, USDJPY has faced further downside pressure, breaking below the 138.42 support level. The currency pair is expected to continue its decline, targeting the next support level at the 137.42 area. Immediate resistance is situated at 139.25, and only a break above this level would suggest a potential completion of the current downtrend. Traders should closely monitor these support and resistance levels, as well as key market factors, to gain insights into the future movements of USDJPY.