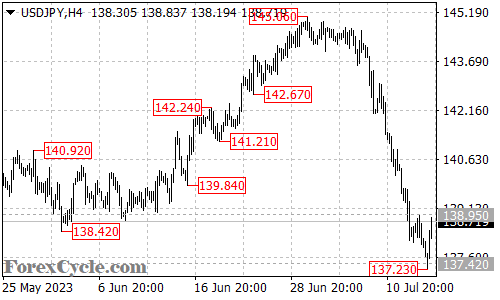

The USDJPY currency pair has entered a consolidation phase after finding support at 137.23, following a downtrend from the high of 145.06. The pair is currently trading within a range between 137.23 and 138.95, as it seeks direction and establishes a new short-term trend.

The recent rebound from the support level suggests that buyers are stepping in, providing some respite for the US dollar against the Japanese yen. However, the presence of the resistance level at 138.95 indicates that sellers are still active and preventing a significant upside move. As long as this resistance holds, the downside bias remains intact, and the pair could be poised for further decline.

Traders should closely monitor the price action within the range, as a breakout from either side could provide valuable clues about the future direction of USDJPY. A sustained break below 137.23 would confirm the resumption of the downtrend and open the door for a potential move towards the 136.00 area, where additional support may be found.

On the upside, a break above 138.95 resistance would suggest that the consolidation phase is ending and could potentially lead to a relief rally. In such a scenario, the pair might encounter resistance around the 141.50 level, which could limit further upside gains.

In summary, USDJPY is currently consolidating within a range between 137.23 and 138.95 after rebounding from the support level. The direction of the next significant move will depend on a breakout from this range. A break below 137.23 would indicate further downside potential, targeting the 136.00 area. Conversely, a break above 138.95 would suggest a possible relief rally, with resistance expected around 141.50. Traders should remain vigilant and adapt their strategies accordingly as the pair seeks a clearer direction.