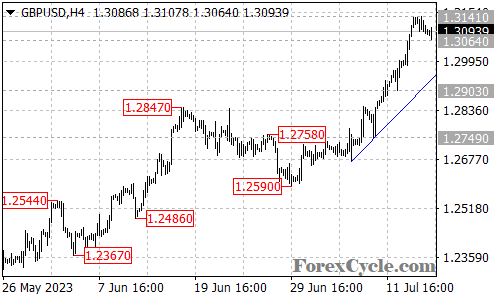

The GBPUSD pair continues to demonstrate strength as it remains above a rising trend line on the 4-hour chart, affirming its position within the ongoing uptrend from the 1.2590 level. Traders can interpret the recent pullback from 1.3141 as a consolidation phase within the broader uptrend, suggesting the potential for further upward movement.

As long as the trend line support remains intact, market participants can anticipate a resumption of the uptrend following the consolidation period. This consolidation serves as a healthy pause in the upward momentum and allows for the market to gather momentum for its next leg higher.

Looking ahead, the next target for GBPUSD lies in the 1.3200 area. Traders should keep a close eye on this significant level as it may act as a psychological barrier and attract profit-taking or increased selling pressure. However, if the pair manages to overcome this resistance, it would signal renewed bullish momentum and potentially pave the way for an extended rally.

Immediate support for GBPUSD can be found at 1.3064. A breakdown below this level could trigger further downward movement towards the rising trend line. It is important to monitor price action around this support level, as a decisive break could indicate a shift in the underlying market dynamics.

In conclusion, GBPUSD remains in an uptrend, supported by its ability to stay above a rising trend line. The recent pullback should be viewed as a consolidation phase within the broader uptrend, suggesting potential for further upside movement. The next target lies at 1.3200, while immediate support is at 1.3064. Traders should remain vigilant and adapt their strategies to evolving market conditions to capitalize on potential opportunities.