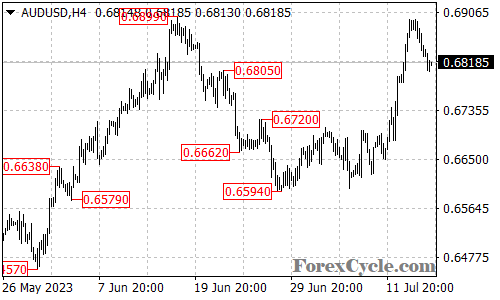

The AUDUSD pair has entered a consolidation phase after breaking below the key support level at 0.6845. This suggests a temporary pause in the uptrend that originated from 0.6594. Traders should anticipate range-bound trading between the levels of 0.6800 and 0.6900 in the coming days as the market gathers momentum for its next directional move.

While in consolidation, it is important to note that the overall uptrend remains intact as long as the 0.6800 support level holds. The current sideways price action can be interpreted as a healthy correction within the broader uptrend, allowing for a potential resumption of upward momentum in the future.

To confirm the continuation of the uptrend, AUDUSD needs to break above the resistance level at 0.6899. Such a breakthrough could trigger renewed buying interest and potentially push the pair towards the psychological barrier at 0.7000.

On the downside, a breakdown below the 0.6800 support level would suggest a potential completion of the recent uptrend. In such a scenario, AUDUSD could find immediate support around 0.6760, followed by a deeper support level near 0.6700. Traders should closely monitor price action and the strength of any potential downside move to assess the validity of a trend reversal.

In conclusion, AUDUSD is currently experiencing a consolidation phase after breaking below the 0.6845 support level. While range-bound trading between 0.6800 and 0.6900 is expected, the overall uptrend remains intact as long as the 0.6800 support holds. A breakout above 0.6899 could signal the resumption of the uptrend with a potential target at 0.7000. Conversely, a breakdown below 0.6800 would suggest a possible trend reversal with support levels at 0.6760 and 0.6700. Traders should remain vigilant and adapt their strategies accordingly as market conditions evolve.