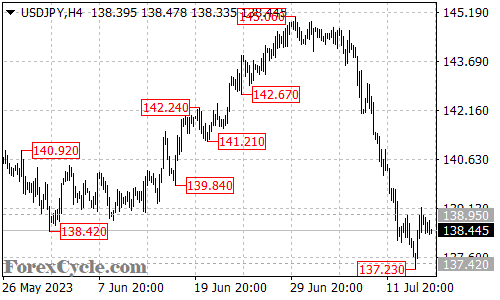

The USDJPY pair has made a significant breakthrough by surpassing the resistance level at 138.95, indicating that the recent downtrend from 145.06 has likely concluded at the support level of 137.23. This development suggests a potential reversal in sentiment, with further upward movement anticipated in the coming days.

Traders should keep a watchful eye on the USDJPY pair as it builds momentum for its next move. The immediate target for the pair stands at 141.00, representing a potential upside of significant magnitude. A sustained rally beyond this level could open the door to additional gains.

To sustain the upward momentum, it is important for USDJPY to hold above the support level at 137.23. A break below this level may signal renewed bearish pressure and could lead to a retest of the lower support level around 135.50. Traders should closely monitor price action and market dynamics for signs of potential downside risks.

In summary, USDJPY has broken above the resistance level at 138.95, indicating a potential reversal of the recent downtrend. Further upward movement is expected, with the next target at 141.00. However, traders should remain cautious and monitor price action closely, as a break below the support level at 137.23 could indicate a shift in sentiment. By staying informed and adapting to evolving market conditions, traders can position themselves for potential opportunities in the USDJPY pair.