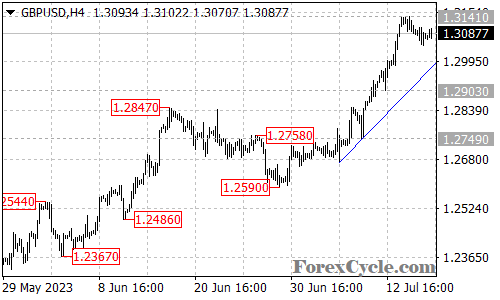

GBPUSD has been exhibiting a strong uptrend, continuing its ascent from 1.2590 to reach as high as 1.3141. Despite the recent pullback from this high, the overall uptrend remains intact as long as the price stays above the rising trend line on the 4-hour chart.

The recent retracement from the peak of 1.3141 is currently viewed as a period of consolidation for the uptrend. During consolidation phases, price action tends to move within a defined range. For GBPUSD, this range is expected to be between the support level near 1.2980 and the resistance level near 1.3141. Traders should keep a close eye on these levels as potential decision points for trading opportunities.

As the consolidation unfolds, market participants should be prepared for the possibility of range-bound trading between the mentioned support and resistance levels. This scenario often presents opportunities for short-term traders to seek trades within the boundaries of the range.

Looking ahead, if GBPUSD manages to find support at the lower boundary of the range, around 1.2980, another move towards the key level of 1.3200 can be expected. On the other hand, a breakout above the upper boundary at 1.3141 could signal the resumption of the uptrend, with further gains in focus.

In summary, GBPUSD continues to show strength in its uptrend from 1.2590. The recent pullback is considered a consolidation phase, with range trading expected between 1.2980 and 1.3141. As long as the price remains above the rising trend line on the 4-hour chart, the overall bias remains bullish. A breakout above 1.3141 could lead to further gains, while a breakdown below 1.2950 may signal deeper corrective moves. Traders should exercise prudent risk management and stay informed of market developments to make informed trading decisions.