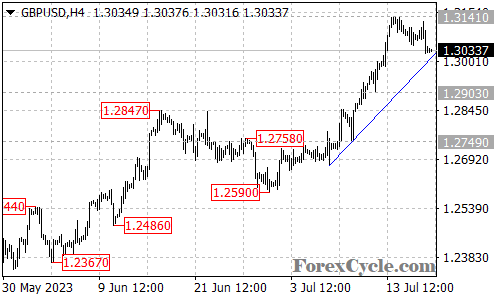

GBPUSD is currently at a crucial point as it encounters the support of a rising trend line on the 4-hour chart. Traders are closely monitoring this level as it may hold the key to the future direction of the pair. Let’s delve into the current situation and potential scenarios.

The pair has experienced a notable upside move from 1.2590, reaching as high as 1.3141. However, the recent pullback from this high has put the pair in a consolidation phase. The rising trend line support is now acting as a critical level to determine the pair’s next move.

As long as the trend line support remains intact, there is a possibility that the pullback is merely a consolidation phase for the uptrend from 1.2590. In this scenario, traders could expect another rise towards the 1.3200 area once the consolidation is completed.

However, if the trend line support is broken, it may signal the completion of the recent upside move at 1.3141. Such a breakdown could attract additional selling pressure and push the pair lower. In this case, the pair might find support levels at 1.2950, followed by 1.2800.

Traders should closely monitor the price action around the rising trend line support to gauge market sentiment. A strong bounce from this level might indicate continued bullish momentum and reaffirm the uptrend. On the contrary, a decisive break below the trend line support might signal a shift in market sentiment and invite more bearish positions.

In conclusion, GBPUSD is currently testing the support of a rising trend line, and this level will be a critical determinant of its future path. As long as the trend line support holds, the pair could see another uptrend towards 1.3200 after the consolidation. However, a breakdown below the support might signal a potential reversal, with support levels found at 1.2950 and 1.2800. Traders should exercise caution and remain vigilant of any market-moving developments to make well-informed trading decisions.