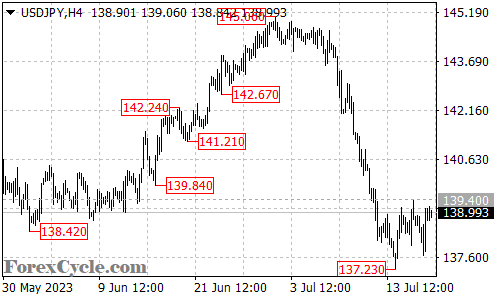

USDJPY has been moving sideways, confined within a trading range between 137.23 and 139.40. This consolidation phase has offered traders an opportunity to assess market sentiment and prepare for potential breakout opportunities. Let’s examine the current outlook and possible scenarios for the pair.

The range-bound movement of USDJPY has created a clear trading range with defined support and resistance levels. The upper boundary of the range is at 139.40, while the lower boundary is located at 137.23. Traders will closely monitor the price action around these levels for potential breakout signals.

A breakout above the resistance at 139.40 could trigger a further upside move for USDJPY. In this scenario, traders may anticipate a rally towards the next target at 141.00. This level will be crucial as it represents a significant resistance area and could act as a potential turning point for the pair.

On the other hand, should USDJPY break below the support at 137.23, it could indicate a shift in market sentiment. Such a breakdown might attract additional selling pressure, potentially leading to a decline towards the next support level at 135.50. Traders should closely monitor the price action and volume around these levels to confirm the strength of the breakout or breakdown.

In summary, USDJPY has been trading within a range between 137.23 and 139.40. Traders will be watching for a potential breakout above 139.40, which could lead to an extended rally towards 141.00. Conversely, a breakdown below 137.23 could indicate a bearish shift, with targets at 135.50. It is crucial to monitor market developments and adjust trading strategies to effectively navigate potential breakout or breakdown scenarios.