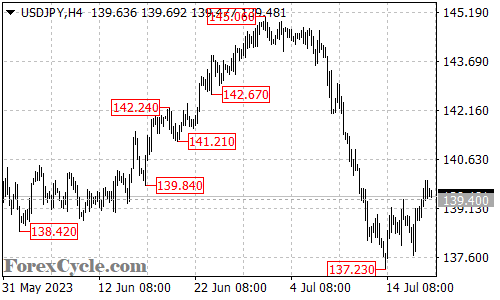

USDJPY has shown remarkable strength, breaking above the critical 139.40 resistance level and reaching as high as 139.98. The ongoing uptrend from 137.23 indicates bullish momentum, and traders are now eyeing the next target at 141.00.

Further Rise Expected:

As USDJPY continues its upward trajectory, the bulls remain in control of the market. Traders are optimistic about the pair’s potential to reach the 141.00 area in the coming sessions.

Immediate Support at 138.50:

In the short term, USDJPY’s immediate support level can be found at 138.50. A minor pullback towards this level may not signal a trend reversal but rather a retracement before a potential continuation of the uptrend. Traders will closely monitor price action around this support level for any signs of strength or weakness.

Downside Targets at 137.23 and 135.50:

If the current bullish momentum falters, USDJPY could see a corrective move towards the 137.23 support level. A break below this level might lead to further selling pressure, with the next downside target being the 135.50 area. However, given the current strong bullish sentiment, a decisive break below 137.23 would be required to signal a shift in the overall trend.

In conclusion, USDJPY continues its uptrend, breaking above 139.40 resistance and aiming for 141.00. Immediate support is at 138.50, and a breakdown below this level might lead to a retracement towards 137.23. However, the overall bullish sentiment suggests that further upside moves are likely.