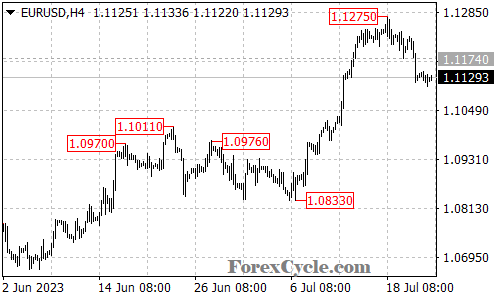

EURUSD has experienced a downside move from its recent peak at 1.1275, with the currency pair reaching as low as 1.1107.

Market analysts and traders are closely monitoring this downward movement, with expectations of further declines in the EURUSD pair. The next significant target is projected to be in the 1.1000 area, as the currency pair continues to face bearish pressures.

Traders are now eyeing the immediate resistance level at 1.1145, which could potentially halt or slow down the downside momentum. A break above this level may provide a temporary reprieve and could bring the price back towards 1.1174. Further strength above 1.1174 might aim for the previous high resistance at 1.1275.

However, the prevailing trend remains bearish, and traders are cautious about the potential for a sustained recovery. Traders are closely watching for any signs of upward pressure but are mindful of the broader downtrend’s implications.

In conclusion, EURUSD faces downward pressure, with the currency pair’s downside move extending to 1.1107. Traders are anticipating further declines, with the next target set at the 1.1000 area. The immediate resistance at 1.1145 is being monitored closely, and a break above this level might provide a short-term reprieve. However, as the bearish trend persists, traders remain cautious about the potential for a sustained recovery. As the market unfolds, traders are closely observing EURUSD’s performance and staying prepared for opportunities amid the ongoing decline in this dynamic currency pair.