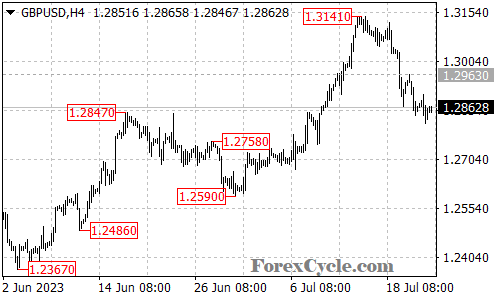

GBPUSD has experienced a notable downside move from its recent high at 1.3141, with the currency pair reaching as low as 1.2815.

Market analysts and traders are closely observing this downward movement, with expectations of further declines in the GBPUSD pair. The next significant target is projected to be in the 1.3750 area, as the currency pair remains under pressure.

Traders are now focused on the key resistance level at 1.2963, which could potentially provide a temporary pause or reversal in the current downtrend. A decisive break above this level may indicate that the downside move has completed, potentially leading to another rise towards the previous high at 1.3141.

However, despite the potential for short-term recoveries, the overall trend remains bearish, and traders are cautious about the possibility of sustained upward momentum.

In conclusion, GBPUSD is currently experiencing downside pressure, with the currency pair’s move extending to 1.2815. Traders are anticipating further declines, with the next target set at the 1.3750 area. The key resistance at 1.2963 is being closely watched for any signs of a potential reversal. Nevertheless, as the overall trend remains bearish, traders remain cautious about the potential for sustained upward moves. As market conditions evolve, traders are closely observing GBPUSD’s performance and staying vigilant for opportunities amid the ongoing decline in this dynamic currency pair.