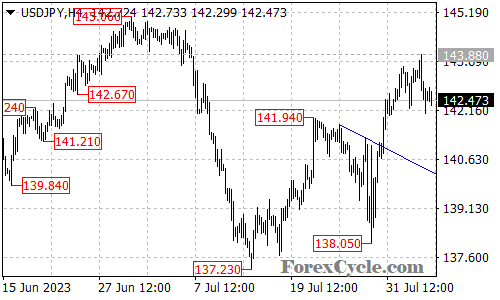

USDJPY has continued its upward movement from 138.05, reaching as high as 143.88.

The subsequent pullback from 143.88 suggests that a consolidation phase for the uptrend is taking place.

It is likely that the pair will experience range trading between the support level at 141.94 and the recent high at 143.88 for the next couple of days.

As long as the support level at 141.94 holds, there is an expectation for the upside move to resume. In this case, the pair could potentially rise further towards the next target at 145.00 after the consolidation.

On the downside, a breakdown below the support level at 141.94 would indicate that the upside move has completed at 143.88. In such a scenario, the pair may find support around the 140.50 level.

In summary, the analysis indicates that USDJPY is currently in a consolidation phase within the uptrend, with a focus on the support at 141.94. Traders should monitor the price’s behavior around this level and the recent high at 143.88 for potential breakout or reversal signals to assess the next moves in the market.