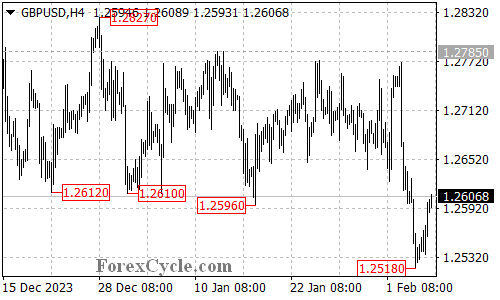

GBPUSD has found temporary solace at the 1.2500 support level, bouncing back from a low of 1.2518. This raises the question: Is a period of consolidation in the downtrend from 1.2827 brewing, or will the decline resume soon? Let’s analyze the technicals to understand the potential scenarios.

Consolidation or Reversal?

- Support Bounce: The bounce from 1.2500 suggests that sellers might be encountering some resistance, potentially leading to a period of consolidation.

- Range Bound: In the near term, range trading between 1.2518 and 1.2670 resistance seems likely.

Downtrend Resumption Possible

- Key Hurdle: If the 1.2670 resistance holds, it could signal the continuation of the downtrend from 1.2827.

- Potential Targets: In this scenario, a breakdown below 1.2500 could open the door for further decline towards 1.2400.

Upside Reversal on the Horizon?

- Breakout Hope: Conversely, a decisive break above 1.2670 resistance would paint a much different picture.

- Upside Potential: Such a breakout would suggest that the downtrend might have ended at 1.2518. This could pave the way for a potential retest of the previous resistance at 1.2785.

Overall Sentiment

The current price action leaves GBPUSD’s near-term direction uncertain. Consolidation between 1.2518 and 1.2670 seems probable in the coming days. However, the outcome of this range will be crucial: a break above 1.2670 could signal a trend reversal, while a decline below 1.2500 would indicate a continuation of the downtrend.