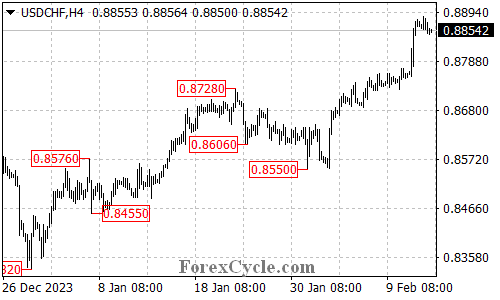

USDCHF has been on a tear, extending its upward journey from 0.8550 to reach a new high of 0.8885. But will this bullish momentum continue, or is a period of consolidation or even a pullback on the horizon? Let’s delve into the technical analysis to understand the potential scenarios.

Uptrend Potential and Target in Sight

- Momentum Building: The recent surge suggests strong buying pressure behind USDCHF, raising the possibility of further gains.

- Next Hurdle: If the rally persists after a minor consolidation phase, the next potential target to watch is the 0.9000 area. Beyond that, an even more ambitious target of 0.9200 could be possible.

Support Levels to Monitor for Pullbacks

- Initial Cushion: The first line of defense for the bulls is the initial support at 0.8820.

- Consolidation or Pullback: A breakdown below this level wouldn’t necessarily signal a trend reversal, but it could indicate a period of consolidation within the uptrend or a temporary pullback.

- Further Support: If a pullback occurs, the next potential support zone lies around 0.8775.

Overall Sentiment

The technical picture leans towards a bullish outlook for USDCHF in the near term. The recent uptrend and strong momentum suggest potential for further gains towards 0.9000 or even higher. However, it’s crucial to monitor the support levels, as a breakdown below 0.8820 could indicate a potential consolidation or pullback.