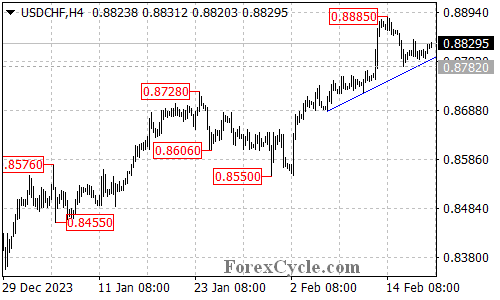

USDCHF continues its upward journey, staying above a rising trend line on its 4-hour chart. This indicates that the uptrend, initiated at 0.8550, remains in play. But will the recent pullback lead to further gains or just a temporary pause? Let’s analyze the technicals to understand the possible scenarios.

Uptrend Intact: Consolidation or Continued Rise?

- Trend Line Support: As long as the price stays above the rising trend line, the uptrend is likely to continue. This suggests potential for further upside after the current consolidation phase.

- Pullback as Consolidation: The recent retreat from 0.8885 could be interpreted as a healthy consolidation within the larger uptrend.

Resistance Levels to Watch for Breakout

- 0.8845 Initial Hurdle: Overcoming this initial resistance level could trigger another upward move, potentially retesting the previous high of 0.8885.

- 0.8885: Retest or Higher Target?: Reclaiming this level would be a positive sign for the bulls, potentially paving the way for a climb towards the 0.9000 area.

Support Levels to Monitor for Pullback

- 0.8782 Key Support: A breakdown below this crucial level could signal a potential end to the current uptrend and indicate that the recent rally might have peaked at 0.8885.

- 0.8650 Next Support: If the selling pressure intensifies and breaks below 0.8782, the next potential support zone lies around 0.8650.

Overall Sentiment

The technicals favor a bullish outlook for USDCHF in the near term. The uptrend remains intact, and further gains towards 0.9000 are possible as long as the price stays above the trend line support and key resistance levels are overcome. However, a breakdown below 0.8782 could suggest a potential trend reversal and downside move towards 0.8650 or lower. Monitoring the price action around the mentioned support and resistance levels will be crucial in determining the pair’s next move.