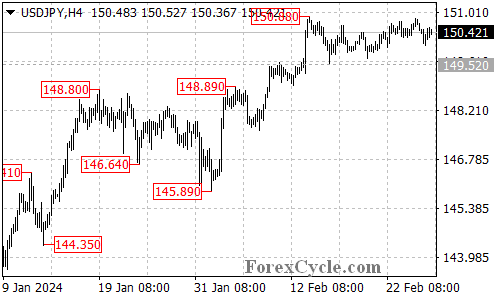

USDJPY is currently locked in a trading range between 149.52 and 150.88, unable to break above the key resistance level. This technical analysis explores the potential implications of this price action, considering both bullish and bearish scenarios.

Uptrend on Hold: Consolidation or Stalled Momentum?

- 149.52 Support: The Bullish Anchor: As long as the price remains above this crucial support level, the uptrend initiated at 145.89 remains valid. This suggests the current sideways movement could be interpreted as a consolidation phase within the ongoing uptrend.

- 150.88 Resistance: The Hurdle to Overcome: Bulls need to overcome the resistance at 150.88 to signal a continuation of the uptrend. A breakout above this level could trigger another rise towards the 151.90 resistance, potentially solidifying the uptrend.

Potential Downturn: Watching the Support Crack

- 149.52 Breakdown: Reversal Signal: A breakdown below the 149.52 support level would be a significant development, potentially indicating a completion of the uptrend from 145.89. This could lead to a downturn towards the next support zone around 148.80, marking a potential trend reversal.

Overall Sentiment:

The technical outlook for USDJPY is currently uncertain. While holding above 149.52 suggests potential bullish continuation, a breakdown below this level could signal a trend reversal and further decline. Monitoring the price action around these key support and resistance levels will be crucial in determining the pair’s next move.