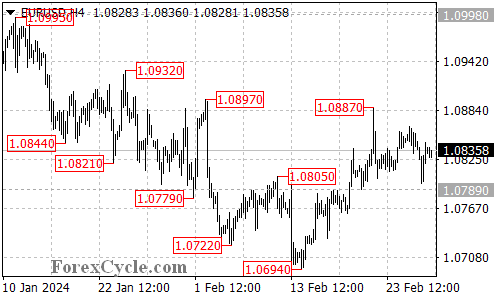

EURUSD has displayed mixed signals recently, failing to break below the 1.0789 support level and subsequently moving sideways. This article analyzes the situation and explores the potential scenarios for the pair.

Uptrend on Hold? Consolidation or Reversal?

- 1.0789 Support Holds: The key takeaway is that EURUSD held above the crucial 1.0789 support level. This can be interpreted as a sign of uptrend resilience and suggests that the recent sideways movement is likely a consolidation phase within the ongoing uptrend that began at 1.0694.

Potential Upside: Breakout Watch

- 1.0887 Resistance: If the bulls manage to regain control and push the price above the 1.0887 resistance, it could signal a resumption of the uptrend and potentially trigger a further rise towards the 1.0950 area, solidifying the uptrend.

Downturn Scenario: Watching for Support Breach

- 1.0789 Breakdown: While the current outlook favors the bulls, a breakdown below the 1.0789 support level would be a significant development. This could confirm the completion of the uptrend from 1.0694 and potentially lead to a decline towards the next support levels at 1.0750 and 1.0694, marking a possible trend reversal.

Overall Sentiment:

The technical picture for EURUSD is currently uncertain. While the support held, suggesting potential uptrend continuation, a confirmed breakout above 1.0887 is needed to truly confirm its strength. Conversely, a breach below 1.0789 could signal a potential trend reversal. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.