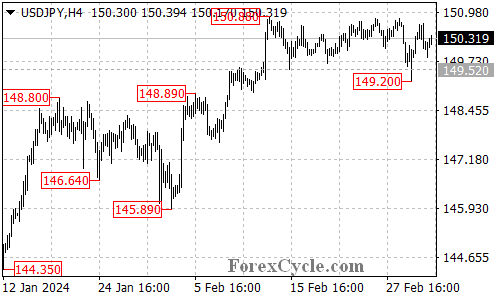

USDJPY has displayed some recent volatility, breaking below support before experiencing a rebound. This analysis explores the current situation and potential future scenarios for the currency pair.

Reversal or Retest? Uptrend Under Scrutiny

- 149.52 Support Tested: USDJPY initially dipped below the 149.52 support level, which had been acting as a key support zone. However, the pair has since rebounded and is now back within the trading range between 149.52 and 150.88.

- Consolidation or Correction?: The current price action within the range could be interpreted in two ways. It could be a healthy consolidation phase within the ongoing uptrend that began at 145.89, allowing the bulls to regroup before another attempt at pushing higher. Alternatively, it could be the start of a corrective move within the uptrend, with the potential for further downside before resuming the uptrend.

Resistance Awaits: Breakout or Rejection?

- 150.88 Resistance: A crucial level to watch is the 150.88 resistance. If the bulls can manage to break above this level decisively, it would be a bullish signal. This could potentially trigger another rise towards the 151.90 resistance, further solidifying the uptrend.

Support Levels: Can the Bulls Defend?

- 149.52 and 149.20: The key support levels to watch on the downside are 149.52 and 149.20. If the price breaks below these levels, it would be a significant development and could indicate a deeper correction or even a potential trend reversal. The next target in such a scenario could be the 148.50 area.

Overall Sentiment:

The technical outlook for USDJPY is currently uncertain. The recent rebound offers some hope for the bulls, but a confirmed breakout above 150.88 resistance is needed to truly confirm the uptrend’s continuation. Conversely, a breach of key support levels could indicate a potential trend reversal. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.