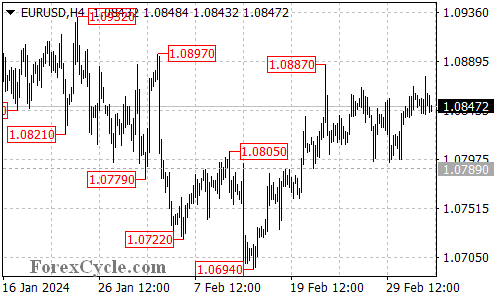

EURUSD has been stuck in a sideways range between 1.0789 and 1.0887 for several days, leaving traders uncertain about the pair’s next move. This analysis explores the technical outlook and potential scenarios for EURUSD.

Uptrend in Limbo: Breakout or Consolidation?

- 1.0887 Resistance: The key level to watch is the 1.0887 resistance. A decisive breakout above this level would be a bullish sign, potentially triggering a resumption of the uptrend that started from 1.0694. This could lead to further appreciation towards the 1.0950 level and potentially even reach the psychological barrier of 1.1000.

- 1.0835 Initial Support: If the bulls fail to break above 1.0887, the initial support level to watch is at 1.0835. A breakdown below this level could indicate a downward correction and trigger another fall towards the 1.0789 support level.

Potential Scenarios: Breakout or Breakdown?

- Upside Scenario: Breakout Above Resistance (1.0887)

- A breakout above 1.0887 would signal a potential continuation of the uptrend, with targets at 1.0950 and potentially 1.1000.

- Downside Scenario: Breakdown Below Support (1.0789)

- A breakdown below 1.0789 would suggest a completion of the upside move and could lead to a decline towards 1.0750 and potentially even retest the 1.0694 low, indicating a possible trend reversal.

Overall Sentiment:

The technical outlook for EURUSD is currently uncertain. The bulls need to overcome the 1.0887 resistance to confirm the uptrend’s continuation, while a breakdown below 1.0789 could signal a potential trend reversal. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.