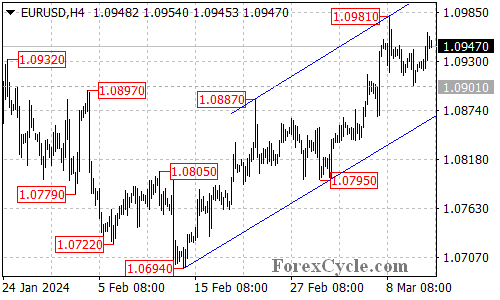

EURUSD has experienced a pullback after reaching new highs, but the technical outlook remains positive. This analysis examines the recent price action and explores potential scenarios for the currency pair.

Uptrend Supported by Channel:

- Rising Channel Intact: EURUSD remains within a rising price channel on the 4-hour chart, indicating the uptrend that began at 1.0694 is still in play. This technical pattern suggests a series of higher highs and higher lows.

- Pullback as Consolidation: The recent decline from 1.0981 is likely a consolidation phase within the uptrend. This is a normal price movement that allows for price stabilization before the potential continuation of the upward move.

Key Levels to Watch:

- Channel Support Crucial: As long as the support level of the rising channel holds, the bullish case remains strong. This suggests a possible resumption of the uptrend.

- 1.1050 as Upside Target: A breakout above the previous high of 1.0981 could propel the price towards the 1.1050 area.

- Support Levels to Monitor: On the downside, the initial support level to watch is at 1.0925. A decline below this level could bring the price back to test the 1.0901 support zone.

- Channel’s Bottom as Important Floor: A breakdown below 1.0901 and the channel’s support would signal a weaker uptrend and could indicate a deeper correction.

Overall Sentiment:

The technical outlook for EURUSD remains bullish in the near term. The uptrend is supported by the rising price channel. While a consolidation phase is underway, a breakout above 1.0981 could signal a continuation of the uptrend towards 1.1050. However, close attention should be paid to the support levels mentioned, especially the channel’s bottom, as a breach could indicate a potential trend reversal.