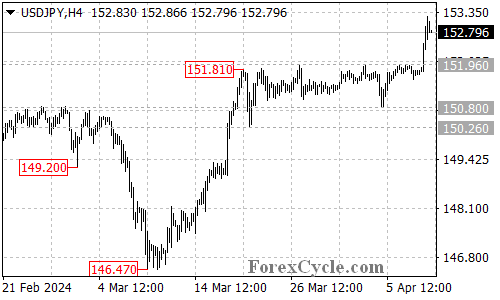

USDJPY has displayed a powerful move, potentially breaking out of a recent range. This analysis examines the technical situation and explores potential scenarios for the currency pair.

USDJPY Stages Breakout:

- 151.96 Resistance Hurdle Cleared: USDJPY has surged significantly, decisively breaking above the resistance level at 151.96. This breakout suggests a potential weakening of the recent consolidation and a possible resumption of the uptrend.

Uptrend Resumed or Short-Lived Rally?

- March Low as Starting Point: The uptrend reference point is considered to be the low point on March 8th at 146.47. The breakout above resistance indicates a possible continuation of the uptrend from that level.

- Upside Potential: Further rise could be expected after a minor consolidation phase. The next potential target zone to watch could be around the 155.00 area.

Support Levels to Consider:

- 152.60 Initial Support: While the immediate outlook appears bullish, it’s important to acknowledge potential support areas. A pullback might encounter initial support around 152.60.

- Downside Risk Limited: A breakdown only below the initial support level at 152.60 could bring the price back towards a potential support zone around 152.00.

Overall Sentiment:

The technical outlook for USDJPY has shifted to bullish in the short term. The breakout above 151.96 resistance is a promising sign for an uptrend continuation. However, monitoring price action around the initial support level (152.60) is important to gauge the strength of the move.